Last week, WTI front month printed an intra-week high of 8395 on Mon; and an intra-week low of 7770 on Fri; closing the week at 7800. As can be seen from the daily candlestick chart above, selling dominated the entire week. Economic news out of China and the week's EIA petroleum report were both bearish factors that helped drive crude prices lower. As we noted last week, 7800 represents reasonable support, however, even though the Percent R oscillator is now indicating a strong oversold reading, the market may drift lower yet to next support level ~7700-7600. The Feb10 contract comes off the board this week after the 20th, so volume in the Mar10 contract will increasingly be more indicative of market sentiment. Monday is a holiday in the US, so trading will be thin tomorrow - and may be volatile as a result.

Watch for consolidation at ~7700-7600, and if this level holds, a reversal higher. A gap opened up between Tue and Wed that the market may try to go back and fill. If the bulls take the market back, a re-test of 8400 could be in play. The Goldman Sachs 2010 forecast of $90 average received a fair amount of media last week, and whether or not markets agree with that outlook, what they say tends to still have an influence on sentiment. Also, the CFTC proposal to control non-commercial participation appears to have been interpreted as moderate, relative to expectations, so this may embolden the bullish skew in the price profile. On the bearish side, U.S. petroleum fundamentals in general continue to be unsupportive. Earnings reporting out of the U.S. over the next weeks will influence views on the strength and rate of recovery of the global economy.

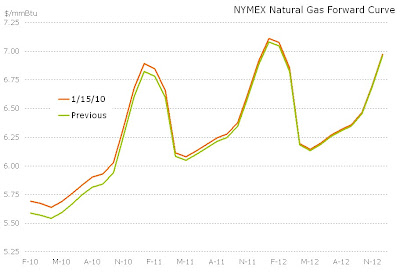

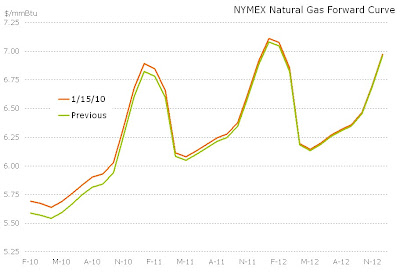

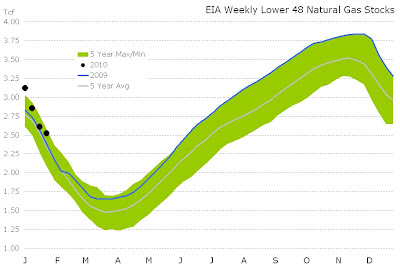

NYMEX natgas put in a range-bound week between 580-540. A large draw on U.S. stock levels was bullish, but was overwhelmed by above normal weather temperatures and a forecast that indicates more of the same. The technical price profile suggests a bearish pennant is in development, implying that a significant test of 540 support could be in play in the near term. On the bullish side, a return to even 'normal' winter weather will provide support, and a return to above normal cold could take the front of the curve back to 600. Inventory levels are now back to within the five year range, albeit they remain above the five year average and last year's level.

Jan. 29 (Bloomberg) -- Commodities headed for the biggest monthly drop in 13 months on concern that demand may wane as governments seek to control economic growth.

Jan. 29 (Bloomberg) -- Commodities headed for the biggest monthly drop in 13 months on concern that demand may wane as governments seek to control economic growth.

The top chart above shows clearly how 7400 provided consistent support from late Fri through to early trading today. Even after the EIA data was released, that support level held firm, giving market momentum to bounce to 7500 resistence. However, at that point there was little motivation for the buy side to push price higher: the EIA products data were bearish; equities were weak; and the USD was strong. When price reached 7400 support for a second time today it lingered only 10 minutes before trading off strongly. Although price did retrace 2/3 of the breakout lower, expect 7400 to now represent new resistence.

The top chart above shows clearly how 7400 provided consistent support from late Fri through to early trading today. Even after the EIA data was released, that support level held firm, giving market momentum to bounce to 7500 resistence. However, at that point there was little motivation for the buy side to push price higher: the EIA products data were bearish; equities were weak; and the USD was strong. When price reached 7400 support for a second time today it lingered only 10 minutes before trading off strongly. Although price did retrace 2/3 of the breakout lower, expect 7400 to now represent new resistence.

Stocks mmbbls

Stocks mmbbls

Jan. 23 (Bloomberg) -- Concern that short-sellers accelerate stock declines may prompt the Securities and Exchange Commission to adopt a rule next month aimed at curbing bearish bets when equities are plunging.

Jan. 23 (Bloomberg) -- Concern that short-sellers accelerate stock declines may prompt the Securities and Exchange Commission to adopt a rule next month aimed at curbing bearish bets when equities are plunging.

This week WTI traded a Three Black Crows candlestick formation Wed thru Fri, after trading a head-fake bull trap on Tue. Price action suggests more weakness in the week ahead, but possibly not as aggressive as this week, 7200 should provide some support. If this level is broken, then ~6900 represents next significant support. Care should be take on the bearish side short-term though. The USDX actually closed marginally lower on Fri, which is not entirely supportive of the bearish view for equities and commodities. Technically, while there may be room for more downside on WTI, the Percent R oscillator is indicating an oversold condition, suggesting a pause/reversal near-term is likely. Trader commentary noted that equities volume last week did rise relatively with the fall in prices, but not enough to suggest a massive correction is underway - yet.

This week WTI traded a Three Black Crows candlestick formation Wed thru Fri, after trading a head-fake bull trap on Tue. Price action suggests more weakness in the week ahead, but possibly not as aggressive as this week, 7200 should provide some support. If this level is broken, then ~6900 represents next significant support. Care should be take on the bearish side short-term though. The USDX actually closed marginally lower on Fri, which is not entirely supportive of the bearish view for equities and commodities. Technically, while there may be room for more downside on WTI, the Percent R oscillator is indicating an oversold condition, suggesting a pause/reversal near-term is likely. Trader commentary noted that equities volume last week did rise relatively with the fall in prices, but not enough to suggest a massive correction is underway - yet.

A return of 'normal' winter weather to the US NE has lifted HH from 540 support through recent 580 resistance. Another large draw on inventory levels last week has placed stocks well back within the five-year range. Seasonally, the market is beyond the midpoint of the 2009/10 winter season, so, barring aggressive extended cold weather, any price rises should be transitory, with traders/analysts estimating what stock levels will be at the end of this heating season - providing either a bearish or bullish skew, depending on stock forecasts. 600 should represent moderate to significant near-term price resistance.

A return of 'normal' winter weather to the US NE has lifted HH from 540 support through recent 580 resistance. Another large draw on inventory levels last week has placed stocks well back within the five-year range. Seasonally, the market is beyond the midpoint of the 2009/10 winter season, so, barring aggressive extended cold weather, any price rises should be transitory, with traders/analysts estimating what stock levels will be at the end of this heating season - providing either a bearish or bullish skew, depending on stock forecasts. 600 should represent moderate to significant near-term price resistance.

Jan.18 (FT) Aidan Heavey, founder and chief executive of Tullow, the UK’s fourth-biggest oil company, says his decision this weekend to pre-empt the $1.35bn (£826m) sale of Heritage Oil’s Uganda assets to Eni, the Italian energy group, was all part of a normal day’s business.

Jan.18 (FT) Aidan Heavey, founder and chief executive of Tullow, the UK’s fourth-biggest oil company, says his decision this weekend to pre-empt the $1.35bn (£826m) sale of Heritage Oil’s Uganda assets to Eni, the Italian energy group, was all part of a normal day’s business.